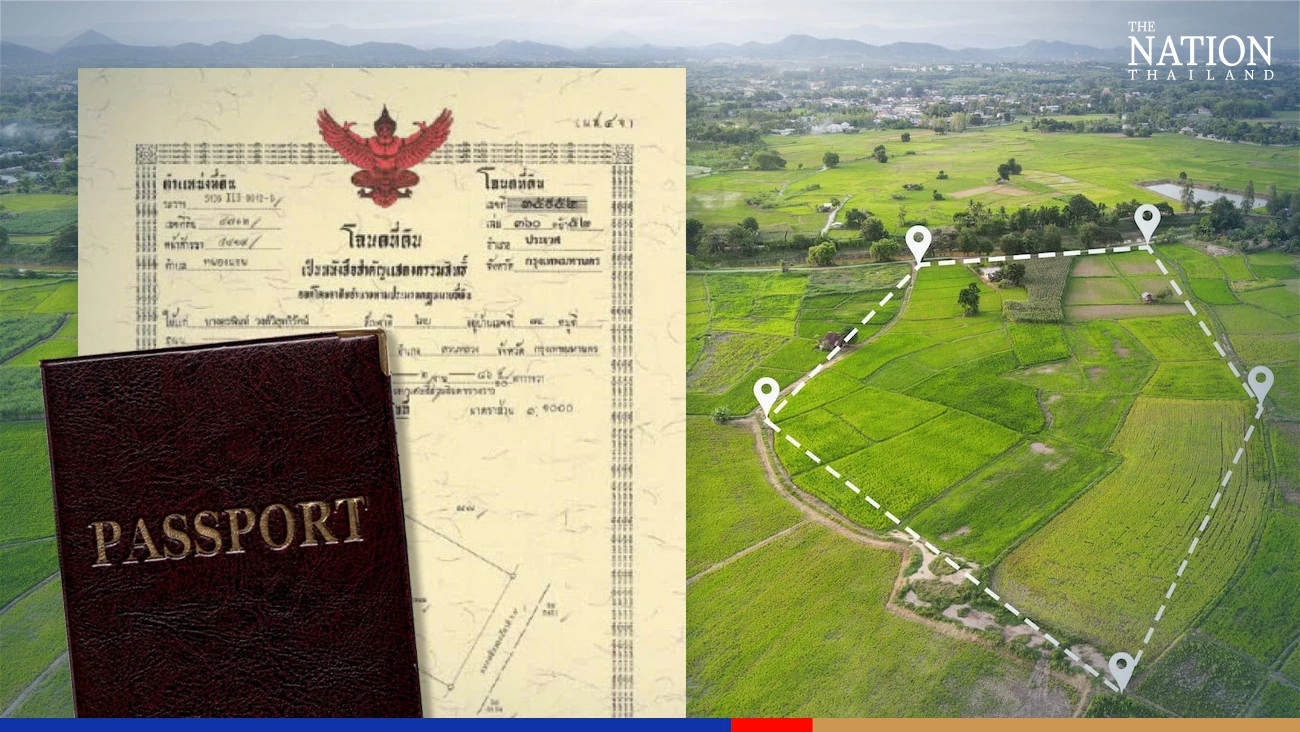

Thailand is a country with a rich culture and stunning natural landscapes, attracting millions of tourists and investors from all over the world. One of the most common questions that foreigners have is the possibility of buying land in this exotic country. According to the current legislation of Thailand, direct ownership of land by foreigners is limited. If you are planning to invest in real estate, you should understand the possibilities and conditions under which this is possible.

Can foreigners buy land in Thailand in 2024?

The situation in 2024 remains largely the same. Foreigners still cannot own land directly. However, there are certain ways that allow you to circumvent these restrictions. One of the most common methods is to create a Thai company in which foreign citizens can own up to 49% of the shares, and 51% should belong to Thai citizens. This approach allows investors to gain access to land and implement their projects.

Choose any property for sale:

- Sale apartment;

- Sale condominium;

- Sale villa;

- Sale house;

- Sale townhouse;

- Sale penthouse;

- Sale bungalow;

- Sale resident;

- Sale office;

- Sale retail space;

- Sale shophouse;

- Sale flat;

- Sale warehouse factory;

- Sale hotels resorts;

Choose any property for rent:

- Rent penthouses;

- Rent apartment;

- Rent townhouses;

- Rent flats;

- Rent offices;

- Rent retail spaces;

- Rent residents;

Another way is a long-term lease of land for up to 30 years with the possibility of extension. This gives foreign citizens the opportunity to intensively use the site without violating Thai law. An important aspect is the careful verification and correct execution of all documents in order to avoid unexpected difficulties.

Is there a land tax in Thailand?

Yes, there is a land tax in Thailand, which must be taken into account when buying or investing in real estate. The land tax is calculated based on the estimated value of the plot and may vary depending on its purpose — residential or commercial. For residential plots, the tax ranges from 0.01% to 0.5% of the assessed value, and for commercial plots it can reach 1%. All tax obligations must be fulfilled on time to avoid fines and additional costs.

In addition, it is important to understand that additional fees may arise when buying a property. These include property transfer tax, registration fees, and other possible expenses. Before making a final purchase decision, it is recommended to consult with professional lawyers or real estate agents to ensure that all norms and nuances are observed.

Thus, there are opportunities for foreign investors in Thailand, but it is important to take into account all the legal subtleties and tax obligations. Be careful and consider your actions before making investments. Thailand offers many attractive options, and with the right approach, your investment can become successful and profitable.